THE increases to Keystart’s property price limits and income limits will help more Western Australians into affordable home ownership sooner, according to REIWA chief executive officer Cath Hart.

The new limits will be set using REIWA median house prices and regularly reviewed to reflect market conditions.

Ms Hart said Keystart provided a valuable service offering loans with as little as 2 per cent deposit and does not charge lender’s mortgage insurance, which is of great benefit to people who find it difficult to get a loan with a traditional lender.

“The loans are subject to price and income limits, which have been unchanged for some time, and the strong property price increases of recent years have resulted in many people being unable to access these loans,’’ she said.

“Lifting the price and income thresholds means the loans will be available to more West Australians, allowing them to make the move into home ownership.”

She said REIWA was proud to have played a role in the review.

“As the peak body for real estate in WA we have unique insights into the WA property market and our data shows what is happening now.

“Linking the price limits to REIWA’s medians means they will reflect actual market conditions and can move with the market as it changes.

“This will ensure as many people as possible remain eligible for Keystart loans.”

As well as changing the price limits Keystart has updated its income limits.

These will reflect the income required to service the property price limits.

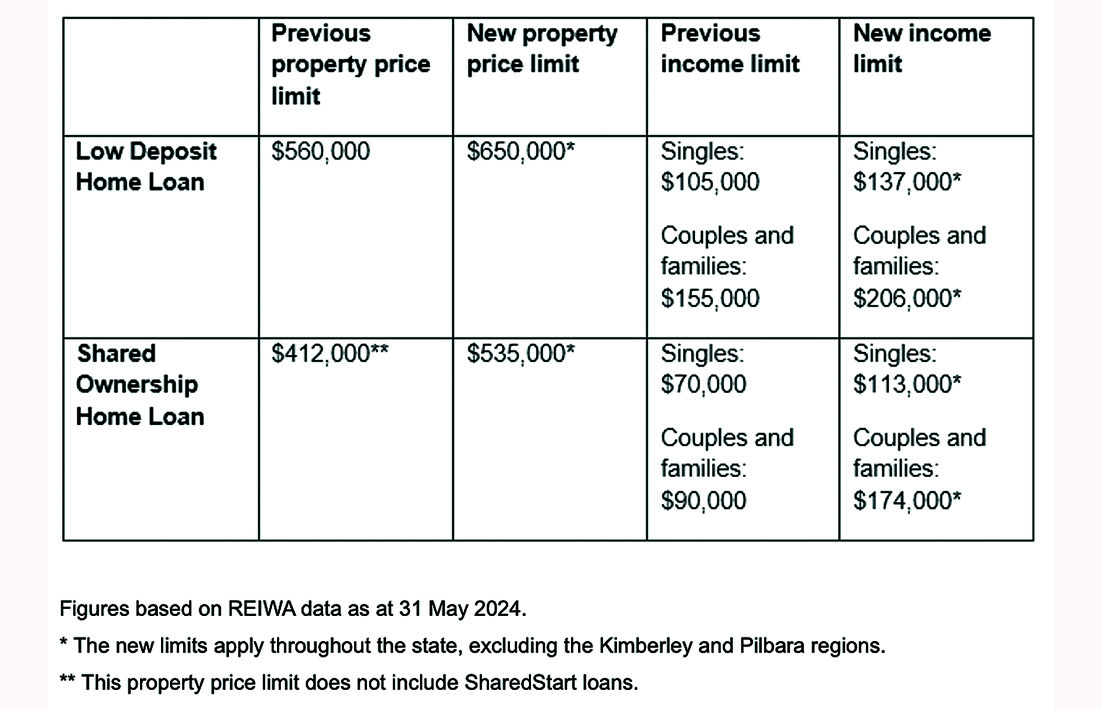

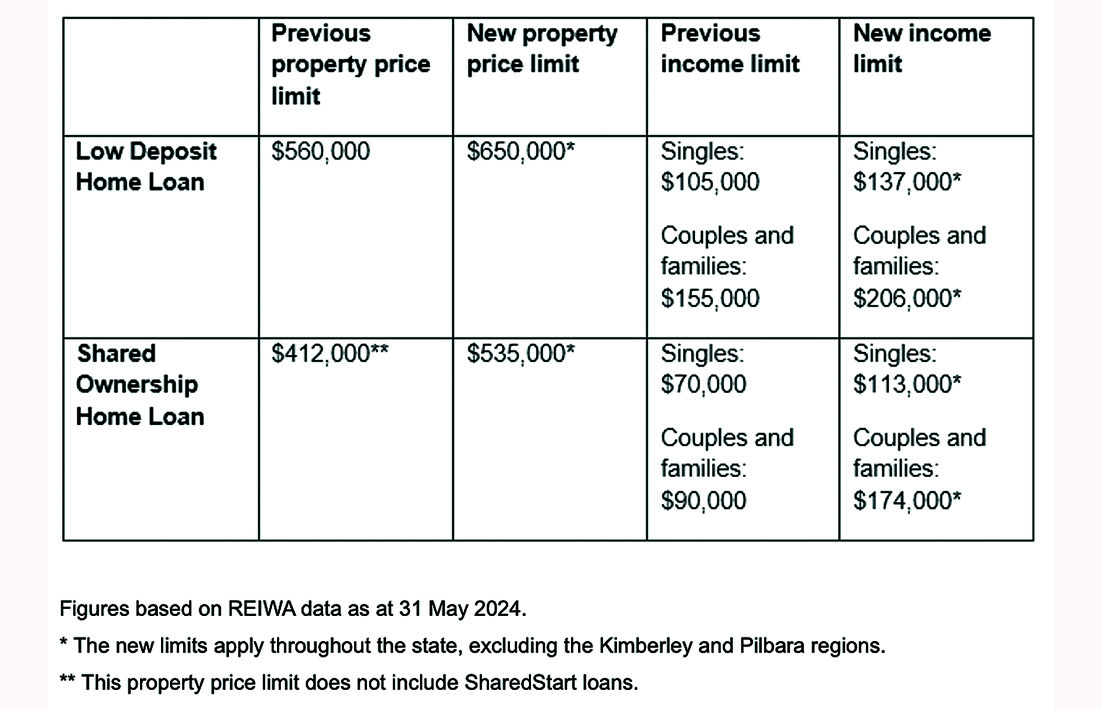

The new property price limits and income limits effective 4 July 2024 are as pictured.

Meanwhile, Bullsbrook and The Vines are two suburbs to record the most growth in Perth property prices in June, according to REIWA.

The suburbs that saw the most growth last month were Queens Park (up 3.4 per cent to $553,000), Bullsbrook (up 2.8 per cent to $575,500), Langford (up 2.4 per cent to $512,000), The Vines (up 2.3 per cent to $875,000) and Wannanup (up 2.2 per cent to $690,000).

Bertram, Piara Waters, Caversham, Seville Grove and Leeming were also among the top performers, recording growth of 1.8 per cent or more over the month.

REIWA chief executive officer Cath Hart said houses in the Perth property market reached a new record median sale price of $660,000, up 1.5 per cent on the $650,000 reported in May and 17.9 per cent higher than June 2023.

The median unit sale price also rose over the month, increasing 1.3 per cent to $440,500. This was 10.1 per cent higher year-on-year.

“While house prices have been setting new records for some time, units remain below the previous record of $450,000 set in 2014,” she said.

“Based on current growth rates they could exceed that in the next few months.

“This is welcome news for people who bought a unit over a decade ago and have been waiting for capital growth.

“It is also a positive sign for new apartment development.

“The discrepancy between unit prices and increased building costs has meant only higher-end apartment projects have been financially feasible for developers.

“This has limited the provision of diverse and affordable housing options for home buyers and investors.

“Growth in the median unit sale price may help stimulate new, more affordable projects.”